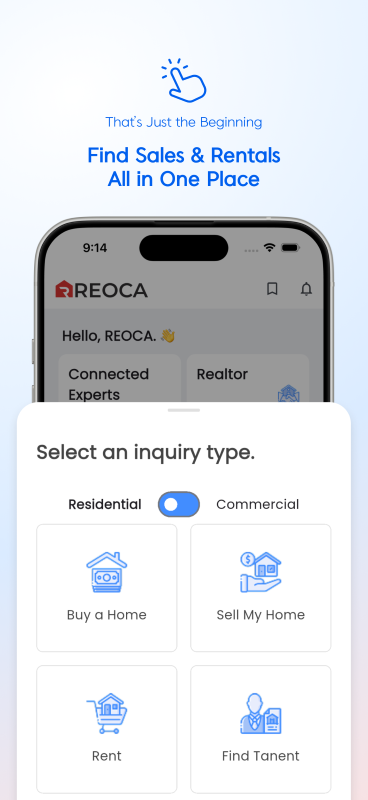

Our Services

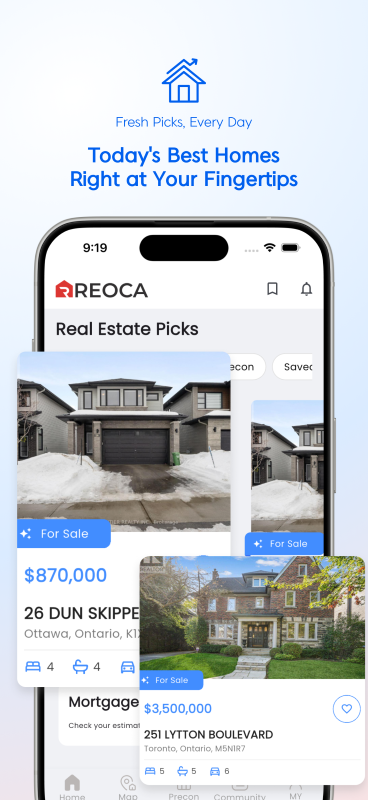

- Real-time property search

- Pre-construction property search

- Connect with real estate professionals

- AI-powered property analysis

- Real estate knowledge & education

- Recommended housing-related service providers

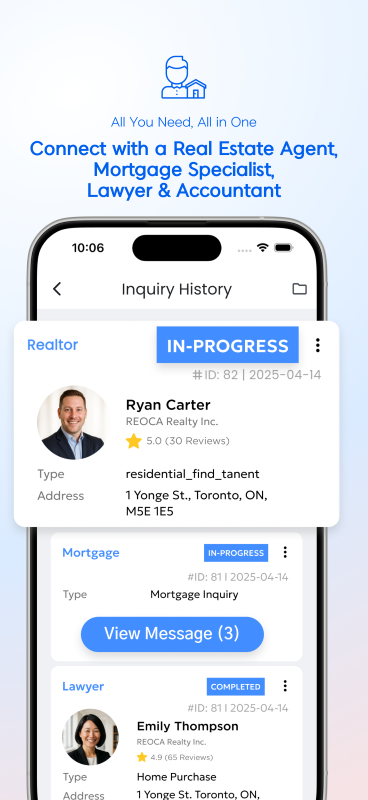

Connect with real estate professionals

Realtor

- Get expert guidance from licensed real estate agents

- Explore homes that fit your needs, budget, and lifestyle

- Receive support throughout the offer, negotiation, and closing process

- Explore homes that fit your needs, budget, and lifestyle

- Receive support throughout the offer, negotiation, and closing process

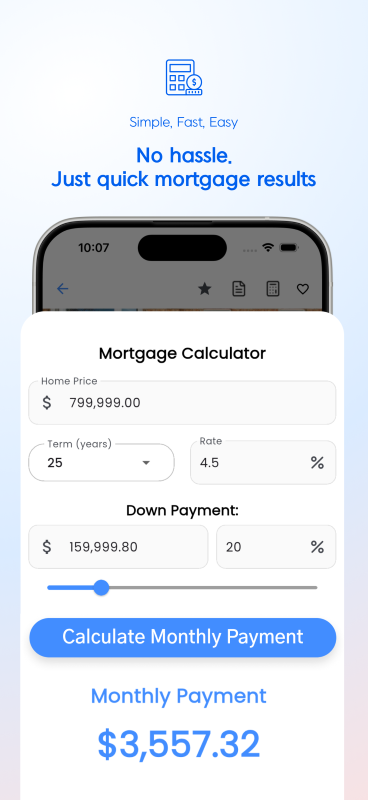

Mortgage Specialist

- Receive professional mortgage consultations tailored to your financial profile

- Access customized solutions designed to meet your specific home financing needs

- Access customized solutions designed to meet your specific home financing needs

Lawyer

- Consult with real estate lawyers to ensure legal clarity and protection

- Get expert support for contracts, title review, and closing documentation

- Get expert support for contracts, title review, and closing documentation

Property Management

- Partner with trusted property managers for ongoing care and tenant support

- Ensure efficient rent collection, maintenance, and property oversight

- Ensure efficient rent collection, maintenance, and property oversight

Accountant

- Consult with real estate accountants for tax planning and financial strategy

- Receive expert guidance on capital gains, deductions, and investment structuring

- Receive expert guidance on capital gains, deductions, and investment structuring

Our Story

Hi, Jin O.

I'm the Co-Founder at REOCA

Every time I tried to buy a property, I felt lost — not because I wasn’t prepared, but because the process itself wasn’t built for people like me.

1

Hi, Jin O.

In 2021

My First Pre-Construction Condo

I purchased a pre-con unit, but struggled to understand the terminology.

Information was scattered, and there was no clear place to get reliable answers.

2

In 2021

In 2023

I purchased a 6 year old condo

This time, every professional I spoke to — agent, mortgage broker, lawyer, accountant — gave different advice.

There was no review system, and no way to know who to trust.

Even worse, I had to coordinate between my lawyer and accountant myself. It was exhausting.

3

In 2023

Once I saw this wasn’t just my problem

I realized I wasn't the only one.

Many people — especially those buying their first home or navigating real estate in a second language — felt the same confusion, isolation, and stress.

There was no one to ask. No system to guide us.

4

Once I saw this wasn’t just my problem

So I built REOCA

I wanted to create what I couldn’t find — a real support system in real estate.

REOCA is designed to:

- Connect you with verified professionals — agents, mortgage brokers, lawyers, and more

- Support you through every step — not just introductions, but real advice and coordination

- Help you make confident decisions — by guiding you with clarity, not confusion

5

So I built REOCA

2024 and Beyond

REOCA is becoming more than a platform — it’s a real estate support system built on trust, simplicity, and inclusion.

We believe everyone deserves a better experience —

no matter your background, language, or where you’re from.

Our mission is to help people from all walks of life navigate real estate with clarity and confidence.

Our mission is to help people from all walks of life navigate real estate with clarity and confidence.

6

2024 and Beyond